The 10-Minute Rule for Estate Planning Attorney

The 10-Minute Rule for Estate Planning Attorney

Blog Article

Some Known Questions About Estate Planning Attorney.

Table of ContentsNot known Factual Statements About Estate Planning Attorney Things about Estate Planning AttorneyThe Best Strategy To Use For Estate Planning Attorney9 Simple Techniques For Estate Planning Attorney

Your lawyer will also assist you make your papers official, scheduling witnesses and notary public signatures as essential, so you don't have to stress concerning attempting to do that final action on your own - Estate Planning Attorney. Last, however not least, there is useful comfort in establishing a relationship with an estate preparation lawyer who can be there for you later onJust put, estate planning lawyers supply value in several methods, far past simply supplying you with printed wills, trust funds, or various other estate intending papers. If you have concerns regarding the procedure and intend to find out much more, contact our workplace today.

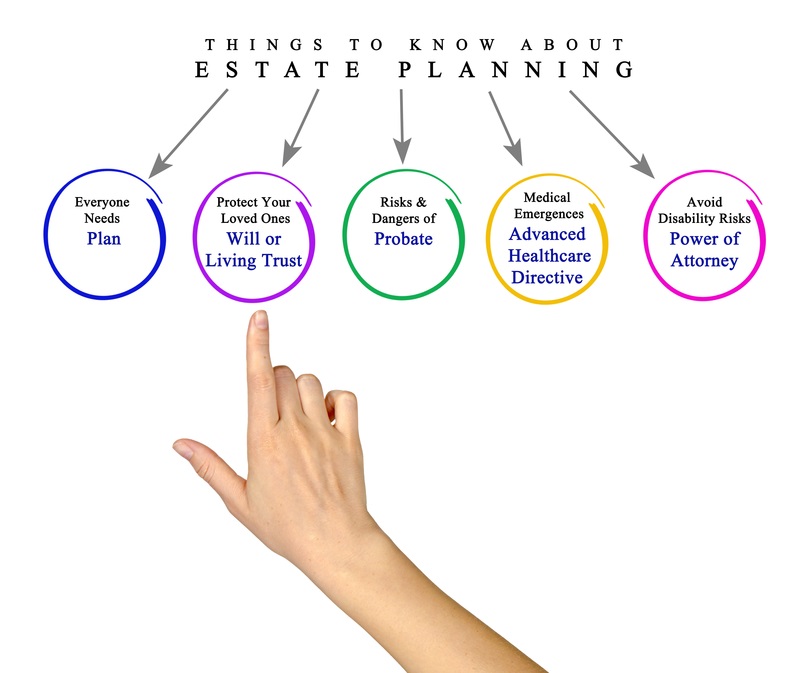

An estate preparation attorney aids you define end-of-life choices and legal documents. They can establish wills, develop trusts, create healthcare instructions, develop power of lawyer, create succession plans, and much more, according to your dreams. Dealing with an estate preparation attorney to finish and manage this legal paperwork can help you in the adhering to 8 areas: Estate intending attorneys are specialists in your state's count on, probate, and tax laws.

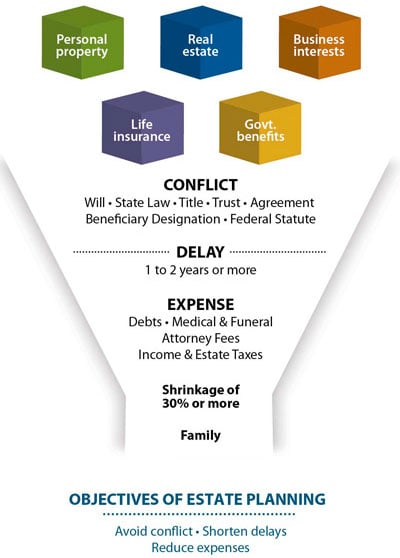

If you do not have a will, the state can choose exactly how to split your properties among your successors, which might not be according to your wishes. An estate preparation attorney can help organize all your lawful files and disperse your properties as you desire, potentially staying clear of probate. Lots of people compose estate preparation papers and after that ignore them.

Estate Planning Attorney - The Facts

As soon as a client dies, an estate strategy would determine the dispersal of assets per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these decisions might be left to the following of kin or the state. Responsibilities of estate planners include: Creating a last will and testimony Setting up depend on accounts Calling an administrator and power of attorneys Recognizing all beneficiaries Naming a guardian for minor youngsters Paying all debts and reducing all taxes and legal costs Crafting instructions for passing your values Developing preferences for funeral plans Completing guidelines for treatment if you become ill and are unable to make decisions Acquiring life insurance policy, special needs revenue insurance coverage, and long-term treatment insurance policy An excellent estate strategy ought to be updated on a regular basis as clients' economic circumstances, individual motivations, and federal and state laws all evolve

Similar to any kind of occupation, there are attributes and abilities that can assist you achieve these objectives as you work with your clients in an estate planner function. An estate planning job can be ideal for you if you have the complying with qualities: Being an estate planner indicates believing in the long-term.

The Ultimate Guide To Estate Planning Attorney

You have to assist your client expect his/her end of life and what will occur postmortem, while at the same time not dwelling on dark thoughts or emotions. Some customers might end up being bitter or distraught when pondering fatality and it might drop to you to aid them through it.

In the event of fatality, you may be expected to have numerous conversations and ventures with enduring family members about the estate plan. In order to Resources stand out as an estate planner, you might require to stroll a great line of being a shoulder to lean on and the individual counted on to connect estate preparation issues in a prompt and professional manner.

tax obligation code transformed hundreds of times in try this web-site the ten years between 2001 and 2012. Expect that it has been changed even more considering that then. Relying on your client's economic revenue bracket, which may advance toward end-of-life, you as an estate planner will certainly have to keep your customer's assets completely legal conformity with any kind of local, federal, or global tax obligation legislations.

Estate Planning Attorney - Truths

Acquiring this accreditation from companies like the National Institute of Licensed Estate Planners, Inc. can be a solid differentiator. Belonging to these specialist teams can validate your skills, making you more eye-catching in the eyes of a potential customer. Along with the psychological incentive helpful customers with end-of-life planning, estate organizers take pleasure in the benefits of a stable revenue.

Estate preparation is an intelligent thing to do despite your present health and economic standing. Not so numerous individuals understand where to start the process. The very first essential thing is to employ an estate planning attorney to assist you with it. The complying with are five advantages of collaborating with an estate planning lawyer.

A knowledgeable lawyer understands what information to include in the will, including your recipients and unique considerations. It also provides the swiftest and most effective method to move your assets to your beneficiaries.

Report this page